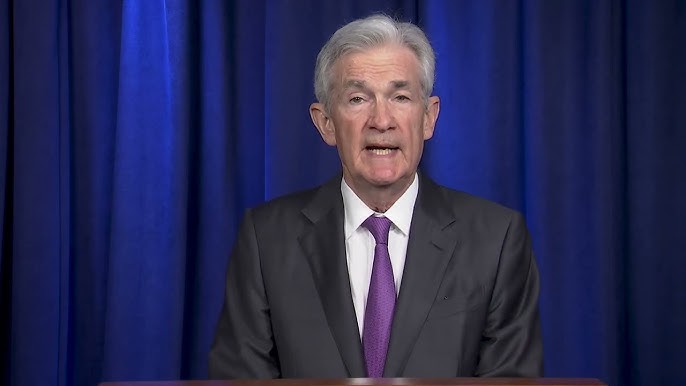

It has been noted that by speaking at the Jackson Hole Symposium, Federal Reserve Chairman Jerome Powell is actually raising hopes for possible interest rate cut in September. A lot of people have interpreted his statement, “The time has come to adjust policy” as a plain sign that the Feds are ready to change their monetary policy on account of prevailing economic conditions.

Minutes from July’s Federal Open Market Committee (FOMC) meeting had already implied some members were willing to reduce rates. Nonetheless, Powell’s speech emphasized on labor market suggesting change in focus for the Fed where employment data is seen as more important than inflation.

Shifting Fed Priorities

This shift in view reflects continuing signs of falling inflation and recent softening in labor market activity. According to him, any judgments concerning whether or when to slash rates will entirely depend on forthcoming economic news. Especially crucial would be employment reports indicating what decisions should be taken by the FED in the future. If the unemployment rate rises further, then it can be expected that there will be a strong reaction from FOMC.

A number of analysts now envision a rate cut in the month of September, followed by two more in November and December. Nonetheless, if weakness in the labor market and economic activity is larger than expected, Fed may consider more forceful monetary easing.

In his speech, Powell emphasized how important it was to look at the labor market when adjusting monetary policy. The FOMC’s chairman highlighted that he didn’t want to see any further slowdowns in employment growth. Instead, it should take necessary steps to promote low unemployment rates while maintaining price stability.

This statement shows that the central bank fears a further increase in joblessness rate. Many FOMC members were surprised when it jumped to 4.3% this July. This change has increased the confidence level of the Fed about its inflation forecast as higher unemployment is suggestive of an emerging output gap.

Concerns about possible inflationary impacts from the labor market were also dealt with by Powell. He suggested that “it does not appear that the labour market will become a major source of upward pressure on inflation in the near future.” Moreover, he added that “labor market conditions are now less tight than just before the pandemic in 2019—a year when inflation ran below 2%.”

There is nothing to worry about as far as the money supply and economy are concerned, Mr Powell said. The rates of interest today, according to him, imply that there still exists ‘ample room’ for the Fed to react if required. This position indicates readiness on behalf of the Federal Reserve to act should economic data require additional support.

+ There are no comments

Add yours